Crypto derivatives are financial products that track the value of crypto assets, such as Bitcoin or Ethereum, without requiring traders to own them. They work like other derivatives in traditional markets, where two parties agree on the terms of a contract to buy or sell the asset at a certain price and time in the future. These contracts can help traders hedge their risk or take advantage of leverage to amplify their returns.

For example, a Bitcoin mining company may sell futures contracts to hedge its natural long position in Bitcoin as they create Bitcoin but could in effect presell its future production. There is growing interest in crypto derivatives. One of the largest derivatives participants globally, Cboe, has just started to trade margined BTC and ETH futures.

The crypto derivatives market is much larger than the spot market, where crypto assets are traded directly, accounting for more than 70% of all retail crypto trading volume.

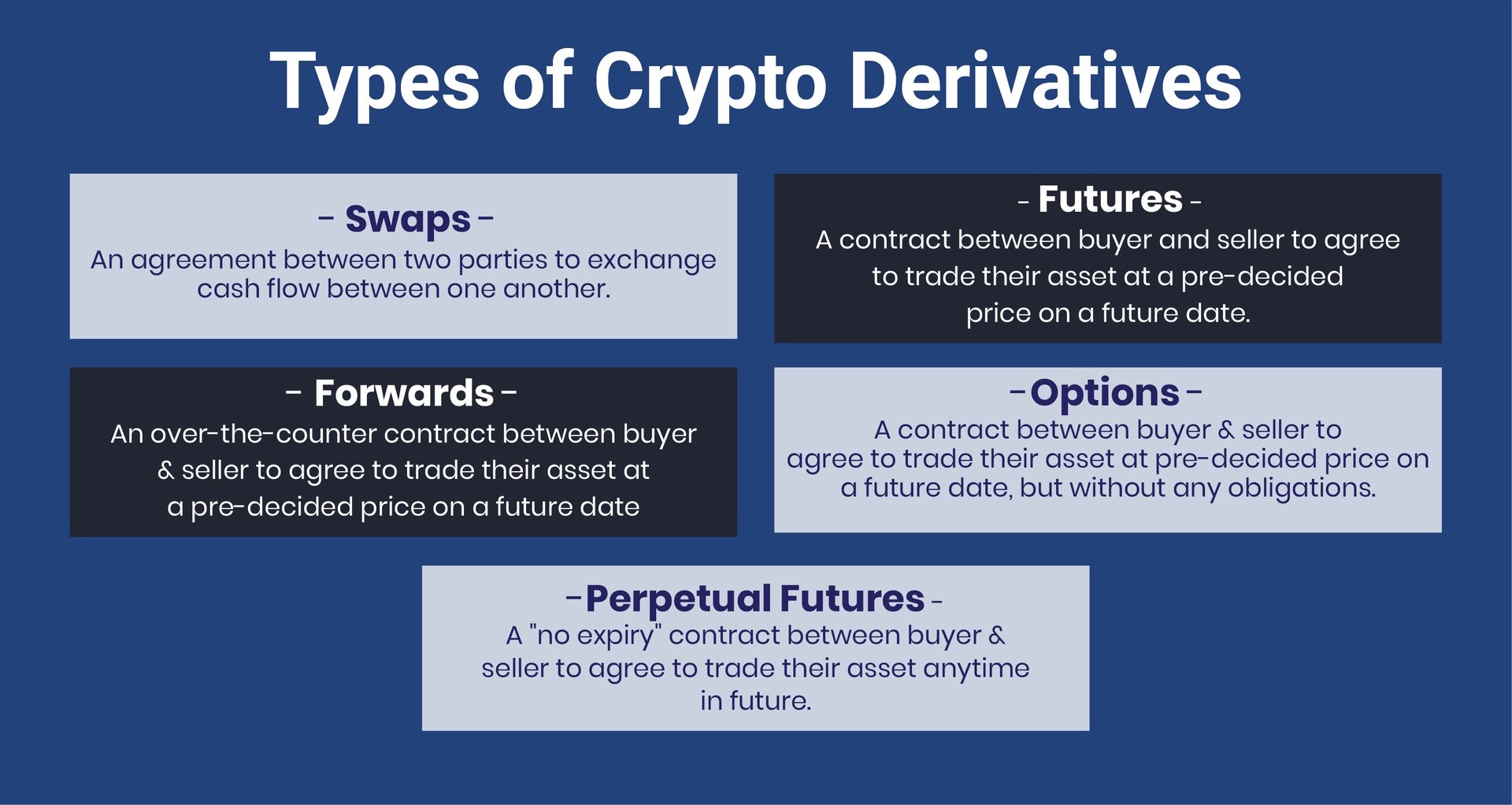

Derivatives come in various forms, but they all include an agreement between two or more parties to purchase or sell an underlying asset at a later date at a specified price.

Some of the most common ones are:

· Futures — directly executed on a regulated exchange, a futures contract is a legally binding agreement between two parties to buy or sell an underlying asset at a given price and date in the future.

· Perpetual futures — sometimes known as “perps,” these are a unique kind of futures contract. As the name suggests, perps are contracts without an expiration date. As a result, the contract’s price is very similar to the spot price (the current price).

· Swaps — a swap is an OTC (over-the-counter) contract similar to a forward contract but not traded on an exchange. It is an agreement between two parties to exchange cash flows later based on a pre-established formula.

· Options — these are contracts that give the parties the right, but not the obligation, to buy or sell the asset at a certain price and date in the future. Options offer more flexibility than futures, as the parties can choose not to exercise their option if it is not profitable; they only lose the premium (i.e., the price they paid for the option).

· Hedging — Crypto traders can use on-chain derivatives to reduce their exposure to price changes. For example, futures contracts allow traders to secure a fixed price for buying or selling an asset in the future. This reduces the uncertainty of the price movement.

Advantages of trading crypto derivatives:

Futures and options can help traders manage their price risk by allowing them to agree on a price now or in the future, or to limit their losses if the price goes down. Derivatives can also be used as a form of insurance against unpredictable price movements, whether they are based on crypto or other assets. Perpetual futures have the benefit of not having an expiration date, so traders do not have to worry about their contracts expiring and having to roll them over. Another feature of derivatives is leverage, which allows traders to pay a fraction of the contract value upfront and increase their exposure to the price changes of the underlying asset.

Trade derivatives on Binance